Managing personal accounts is a task that can be complicated and also boring. The traditional thing is to carry out the management with a notebook and a pen, but currently you can choose to use one of the many applications available in the App Store to carry out the management of monthly finances. In this article we show you some of the most common and also the most recommended.

The most important of these applications

In the App Store you can find many applications that aim to carry out this management of personal finances. Although, being a subject as delicate as the individual economy, it is necessary to choose the option that is safer and also more productive. To help you in this task, we show you a series of points that in our opinion these applications must meet to be practically perfect. These points are the following:

- Aesthetics: an application that is easy to use must begin with a clear and schematic aesthetic. It is not interesting to have an app installed that offers a lot of information at a single glance since it can end up overwhelming a lot and not have a clear vision of how your financial situation is. That is why the fact of having a beautiful and clean aesthetic is prioritized.

- Security: as we have commented previously, we are facing applications where all the expenses are going to be entered. But also income. This means that at all times you can see the amount of money you have in bank accounts or in cash. That is why we must prioritize those apps that guarantee the confidentiality of this data.

- External connections: depending on how you want to manage your money, you can find manual or automatic apps in the App Store. In the event that you have many expenses and you do them with your bank card, it is advisable to look for those apps that are synchronized with the bank itself. In this way all your movements will be registered and the different expense reports can be viewed.

Manual management application

Cash payments are still very present in the day to day. If in your case you do not use the bank card too much and you choose to pay in cash, the manual applications are ideal for your case. You will not be able to carry out an accounting automatically, but you will enter the movements of income and expenses yourself. Next, we show you the best apps in this category.

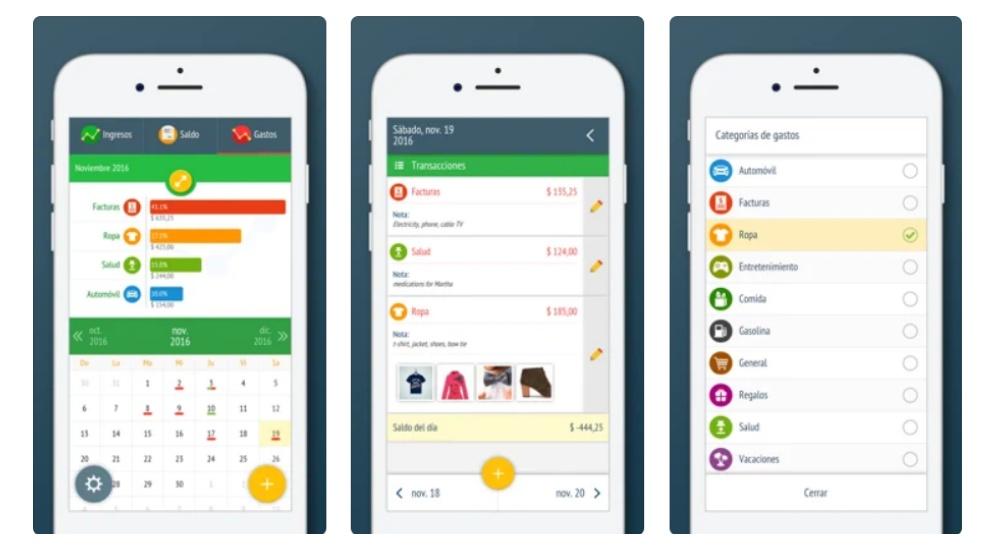

Control of expenses and money

Simple application to have an administration of your expenses and that focuses on quality and simplicity. You will be able to manage money, control expenses and organize all your savings with ease, taking advantage of some of its features. Among these, the calendar stands out on the main screen to see how much you have spent on specific days. In each of the movements you can enter different data such as the place and also the photographs of the products you have bought and even the tickets.

In order to have complete reports, you will be able to create categories of expenses and income. In this way, you can categorize an income as that of your payroll, and an expense within food. In the event that you have to carry out transfers on a regular basis, such as renting, it is important to know that the app enables a reminder system that is ideal.

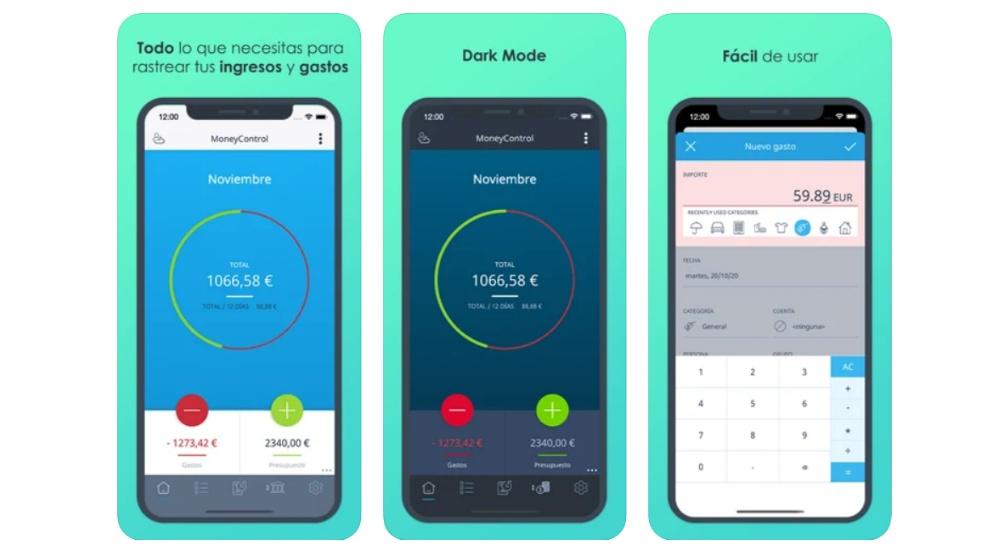

MoneyControl

Application that is designed to perform a domestic accounting by meeting the requirements of being simple and intuitive. The interface is fairly easy to use but offers premium features such as planning and managing family budgets. In this way you can divide your money into what you need to buy food or pay for electricity.

The application has a system to be able to enter the different expenses and income that you have throughout a month. You can enter different data such as the title, the amount of money and also a description of the expense. But if you want to save this, you can take a picture of the purchase receipt to transfer all the data automatically. Note that these functions are available through a subscription system.

MoneyCoach

With this service you can create healthy financial habits to be able to have greater control of all expenses and save at the end of the month. One of the advantages it has is that we are facing a multiplatform application present on the iPhone but also on the rest of the devices of the ecosystem. Control expenses manually, being able to enter a lot of data to have a complete report at the end of the month.

With a simple glance you will have at the end of the month different reports with what you have spent in the different categories that exist. Every day you can also see how your wealth is increasing. Although you cannot have a real-time synchronization with the bank, you can upload a .CSV file downloaded from the bank in order to have all the data in the application.

Monefy: Cost control

With this application you will be able to keep a record of all the expenses that you have on a day-to-day basis in an intuitive way. You will have to add the expenses that you are making by clicking on the ‘-‘ that you will find throughout the application. Here it is important to detail what the expense has been, but also the amount and category. The latter is really important to have detailed graphs of where the money goes in each of the months. As the data requested is quite scarce, the registration is done in a very simple way.

Keep in mind that all this data can be stored in Google Drive, so you can rescue it at any time. The budget mode will always allow you to manage all the expenses on the first of the month to know where you are going to allocate each of the income you have. It integrates a fairly complete calculator to be able to calculate in detail everything that you are spending. All this without any type of ads and with the possibility of protecting it with a password.

MoneyHero

Simple and innovative personal finance manager with which you will not have any kind of hassle since you will not have to connect your bank or complicated things. It is a monthly income and expense manager and at the same time you can save money in a comfortable way. The method that is proposed consists of knowing in advance the money that you will have available to spend during the month. In this way you will be able to know how much money you will have to spend throughout the month.

Each month you will be able to know if your total money has increased and how much compared to the previous month. In a simple way you can add expenses and income, in addition to being able to indicate if it is a fixed monthly (recurring) or variable expense, being able to also manage all the subscriptions you have. On an annual and monthly basis you will have a record with all the expenses and income that you have had.

Options that sync with your bank

If in your case you use the bank card quite frequently and you use the money transfer functions a lot, you are undoubtedly interested in managing it with the appropriate apps. Specifically, we talk about the options that allow you to synchronize all the data of your online banking with the keys for only consultation, so that security is guaranteed. Here we show you the best options that exist in the App Store.

Fintonic

When it comes to managing the personal economy, one of the applications that come to mind is that of Fintonic. A service that connects with all your banking entities in a secure way to have all your expenses concentrated in a single place. This means that you do not have to enter all your expenses manually since simply by updating your accounts the main movements will appear, being ideal if you never move with cash.

When you have been using the application for some time, you will have very extensive reports with a description of each of the expenses. That is, you will quickly see how much you have spent in a specific category when the month ends. In an intelligent way, you will be able to detect when you receive a duplicate direct debit or a card expense that is not correct. This is in addition to the different services available and that can be hired as they will help you apply for a loan or save on your insurance.

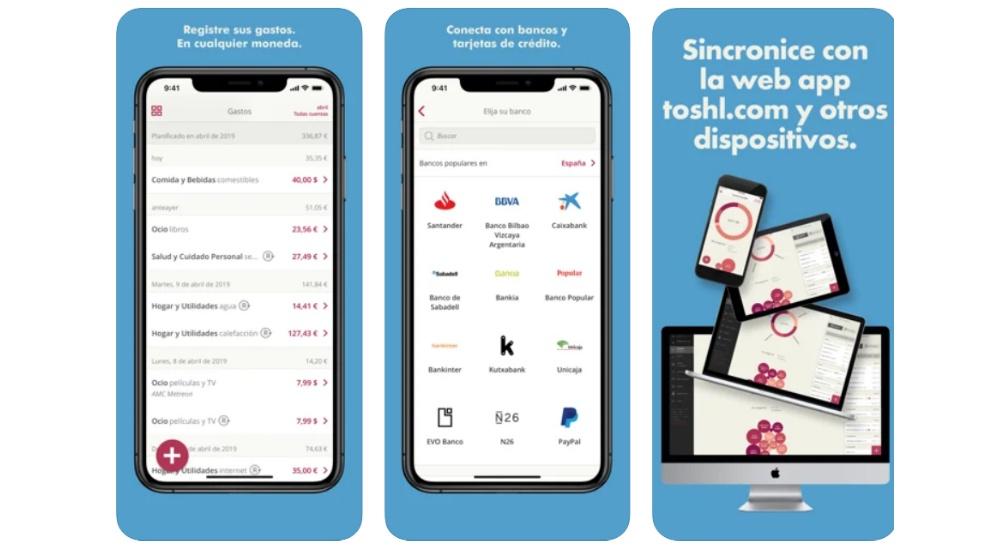

Toshl Finance

If you have many bank accounts or credit cards, but you also use cash to make your purchases, this is the application that you must install on your iPhone. It is currently an application that is endorsed by more than 2 million users. You can automatically connect more than 13,000 bank accounts, credit cards or financial services in Spain or Latin America. In a fast way you can also manage your cash expenses since with four simple touches you will make the registration.

Keep in mind that this is an application that is quite updated to reality. This means that it has compatibility with more than 200 different currencies and also includes the 30 main cryptocurrencies so you can have really complete data with this application. In each of the records you can enter enough data such as labels, financial accounts, repetitions or reminders with notifications.

Money pro

Very complete application to be able to plan your invoices, prepare budgets and keep track of all your accounts. That is why it is an ideal service to prepare household budgets and also for business use. You can quickly create entries to see both the income and the expenses that are being consumed from the budget that you have previously designed with everything you have planned to spend with all your income.

In the event that you get the GOLD subscription you will be able to access the bank synchronization quickly. This will allow you to receive notifications of when the different bills are being paid and also when the different direct debits arrive. In the event that you make purchases in large stores, you can divide the expense into different categories to have it as best classified as possible.

Which are the most recommended

We have been able to see throughout the article that there are many applications that are destined to carry out an integral management of the personal economy dividing the income and expenses by the different available categories. One of the most recommended apps of all these is undoubtedly Fintonic . It offers an automatic synchronization system with your bank accounts. In this way you will be able to see at all times all the expenses and income of your accounts divided by categories. You can even find the tools to make budgets and know at all times if you are complying with them or the progression you are taking with your expenses.

But if you are a person who always carries a lot of cash with you and pays for almost everything with it, Monefy is the app you should have installed. It has an aesthetic that undoubtedly lets you see in a very clear way where all your money has gone over the course of a month. You can quickly enter everything you are spending with a lot of data such as the location, the concept, the description and also of course you can upload images of the product or the ticket.