On April 1, the campaign for the declaration of the Income and Equity corresponding to the 2019 financial year began. A period in which taxpayers must be accountable to the Treasury, despite the fact that this year coincides with the health and financial crisis caused by the coronavirus. Even so, there are many who have already put themselves, or will soon, get down to work to download the draft and to be able to present their statement as soon as possible, especially giving them back. Next, we will show how to get the draft of the 2019 Income.

Although the term began on April 1, taxpayers have time to file the return until June 30. However, if you prefer to file it as soon as possible, then the fastest way is to get the draft to generate our declaration with the data available to us and our activities, the AEAT and proceed with its presentation. It is also possible to modify or add the data that we consider appropriate.

Now, in order to obtain the draft or declaration in Renta WEB, it is necessary to have a reference. For this, we will have to use the REN0 service, being able to obtain the reference of our file in different ways:

- With box 505 of the 2018 financial year.

- With Cl @ ve .

- With Certificate .

Get the reference for the draft of the Income 2019

The REN0 service allows us to obtain the reference of our file immediately in order to speed up the generation of the draft and thus prepare the statement through the Renta WEB service that the Tax Agency makes available from the Income Portal 2019 .

Get the reference with box 505

To do this, all we have to do is visit the Income 2019 portal and in the Featured Procedures section, click on the link or option Get your reference number . Then:

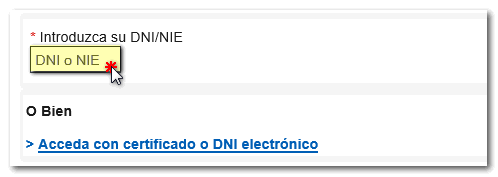

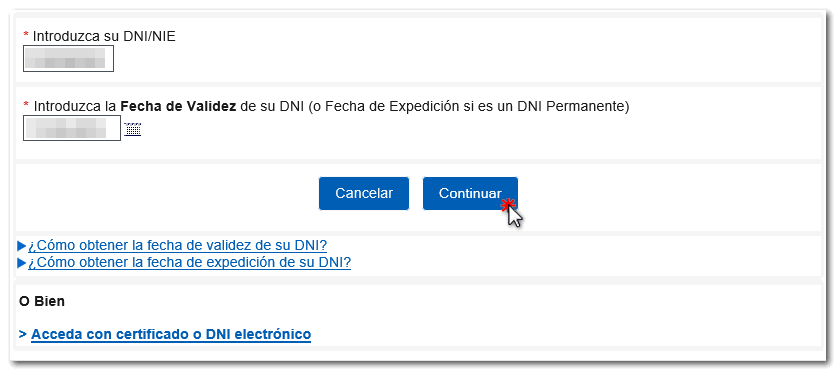

- We introduce our DNI or NIE.

- Validity date of our DNI or support number in the case of using NIE. If it is a NIF without a validity date (type K, L or M), the information that we will have to give is the date of birth that appears in the document.

- Click on Continue.

- We choose the option Get Reference with box 505.

- We enter the value of box 505 of the statement for the financial year 2018. In the event that no statement was filed last year, we have to enter the last five figures of the IBAN of a bank account that we have been holders of in 2019.

- In any case, once this data is indicated, click on Get reference.

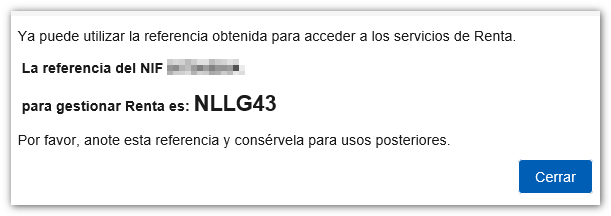

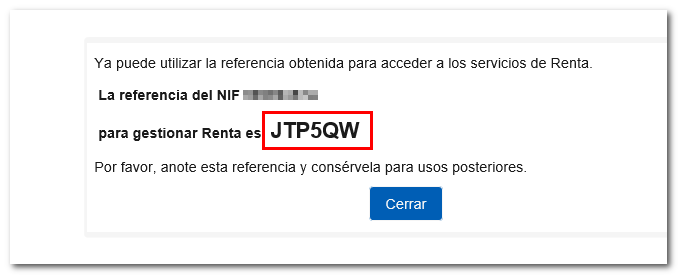

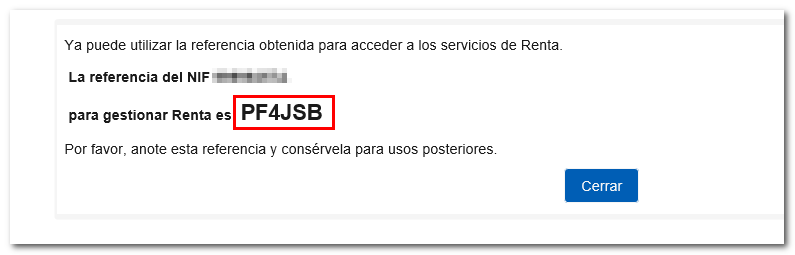

- We will be shown the reference to use to obtain the draft. It is made up of 6 characteristics.

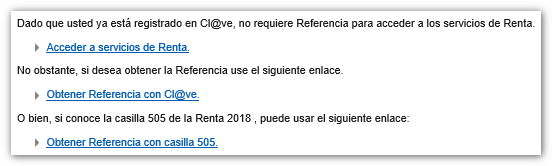

Get reference with Cl @ ve

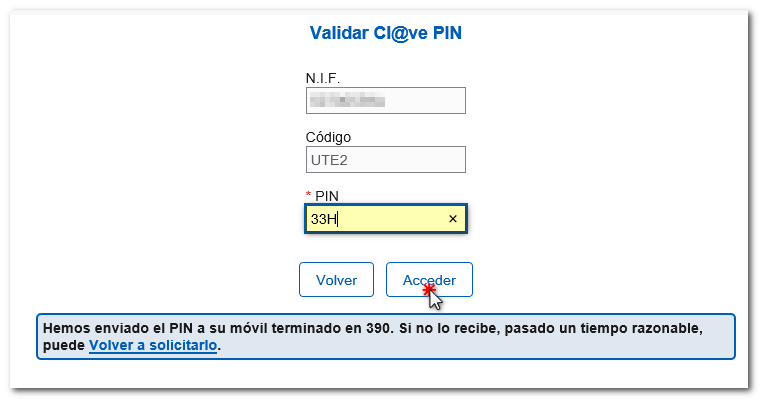

The steps to follow to retrieve the reference with Cl @ ve are the same as those indicated above, but after indicating our ID, NIE and validity date and clicking Continue, we will have to choose the option Get Reference with Cl @ ve. From there:

- In the next window click on Get PIN.

- Then, the corresponding notice will be displayed in the browser depending on the way of receiving the PIN: through the app or through

- In the application you can view the PIN and the expiration time counter, this screen will refresh every 10 seconds, automatically showing the last PIN obtained.

- If we do not have the app activated or installed, we will be informed that the shipment with the PIN will be made by SMS to the associated phone number.

- We indicate the PIN and click on Access.

- Finally, click on Get Reference.

- We will be shown the reference to use to obtain the draft.

Get reference with certificate

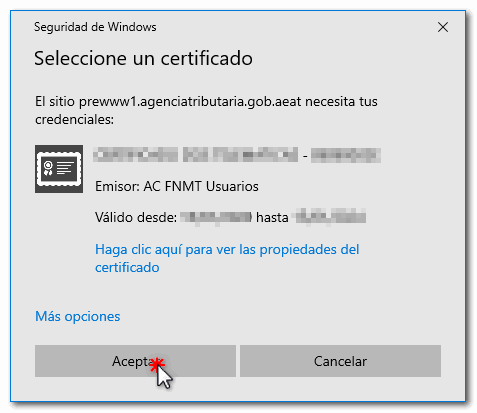

In this case, after clicking on the Obtain your reference number option, from the window where we are asked to enter the DNI or NIE we will have to click on the option Access with certificate or electronic DNI. Then:

- We will be shown the browser certificate selection window, the digital signature, and click OK.

- The reference to use to obtain the draft will automatically be shown to us.

How to get the draft for Income 2019

Once the reference has been obtained, we can already obtain the draft to generate our 2019 Income Tax return. For this, the first thing we are going to do is go to the Income Tax 2019 portal and, under Outstanding Procedures, we click on Draft Processing Service / declaration (WEB INCOME). The steps to follow below are:

- If we have previously accessed Renta WEB, a window will be displayed informing us of the existence of a previous declaration, which can be retrieved by clicking on Continue session. If we want to start a new declaration, then click on New Declaration.

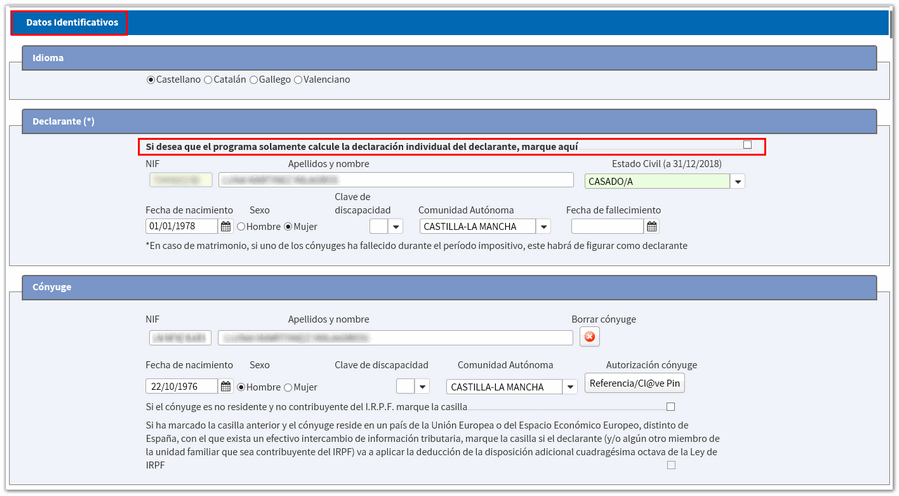

- If it is a new declaration, an initial window will be shown for us to indicate the identifying data of the declarant and the rest of the declarants in the event that it is a family unit.

- Right there we can indicate whether or not we want to enter the spouse’s tax information. If we have checked the box as Married Marital Status, we will have to check the corresponding box to calculate the return individually or jointly.

- In declarations with spouse, if we want to compare the result of the declaration individually and jointly, we will have to have the reference number of the spouse or a PIN code that authorizes us to access.

- We accept the identifying data window

- At that point, the application can detect that certain additional data must be transferred to the declaration. In that case, we will follow the instructions that appear on the screen.

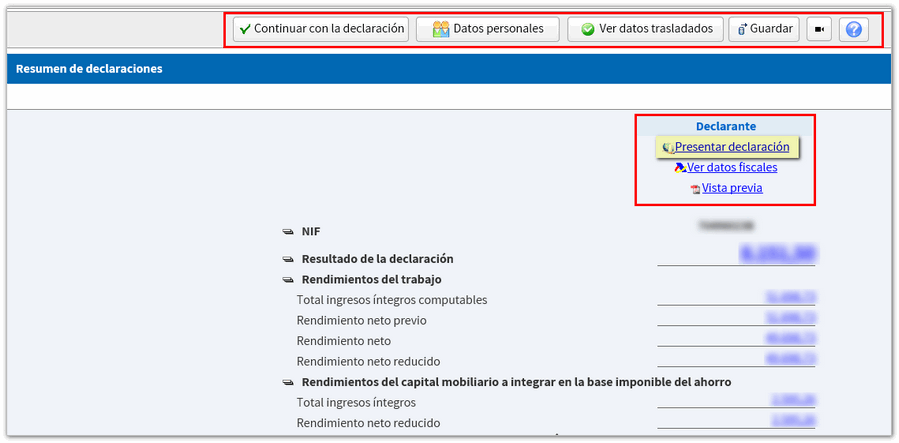

- If no more data is detected to incorporate, then the window where the summary of the statement is shown will be shown. At the top we will see the options to Continue with the declaration, access Personal Data, view the transferred data or Save the draft. There we will see if it comes out to pay or return and the exact amount in each case.

- At the top of the summary, we will have the option to present a declaration, which will be presented electronically. This supposes that we accept the data of the draft, affirming that they are real and the 2019 Income will be presented.