If there is an extremely volatile technology market, it is the NAND Flash market. In 2019 and especially 2018 we experienced a roller coaster with the price of this type of memory and now in 2020 we are climbing prices again. The COVID-19 has created some uncertainty and caused a small drop, but a further rebound is expected as soon as it passes. The problem is that YMTC has gotten into the fight and does not plan to leave a puppet with a head in what has already been called the apocalypse of the NAND Flash.

A tsunami is coming, everyone is on alert and still expected to hit one of them. It is the phenomenon of Yangtze Memory Technologies Company , better known as YMTC, the Chinese manufacturer of NAND Flash with the country’s state budget with which all the big manufacturers are going to go to war, if they are not already.

YMTC, competitive in prices and technology

The problem that all NAND Flash foundries and developers will have to face is that of a cyclone that is barely a few years old and that through “copy and tech” is being terribly competitive.

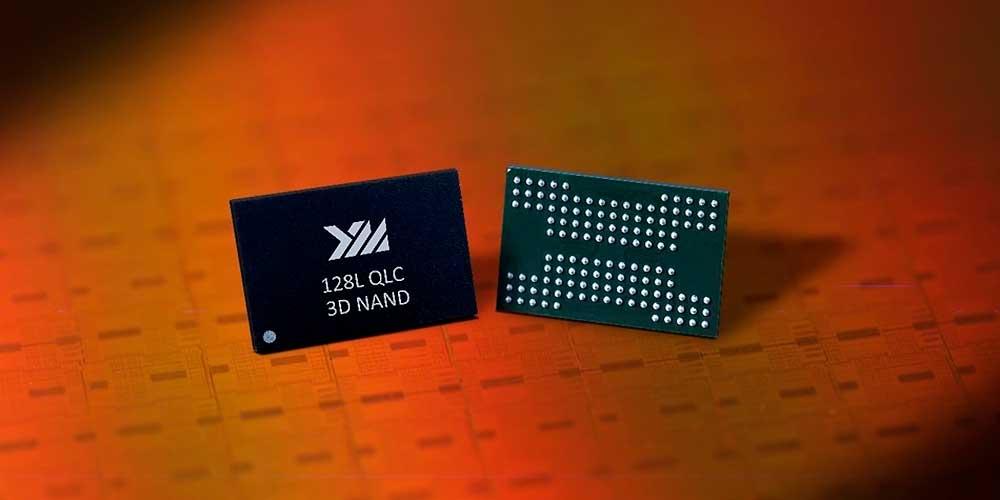

The sector is going to change, the progress of YMTC is extraordinary and as we affirmed not so long ago, soon many of the devices that we will have in our hands will carry Made In China chips. This is already a small reality, since YMTC is currently sending 64-layer NAND Flash under TLC technology, where the most worrying thing is that being the last to arrive, it has achieved the best density on the market.

Comparatively, Samsung achieves on its 64-layer V-NAND chips for 256 GB of capacity a figure of 3.42 GB per square millimeter , which is a respectable figure.

Intel and Micron for their 64 256 GB CuA TLC layers achieve 4.40 GB / mm2 , but YMTC at the same layers and capacity manages to surpass all with 4.41 GB / mm2 .

Therefore, we are talking about an innovative giant, with resources and that is positioning itself as a TOP producer in the market, arriving last at the party. But it is that if we compare it with the rest of manufacturers, YMTC has in this configuration an efficiency in its matrices greater than 90%. Everything is produced thanks to its Xtacking technology, which we have already talked about several times and that promises to put in check all the current giants.

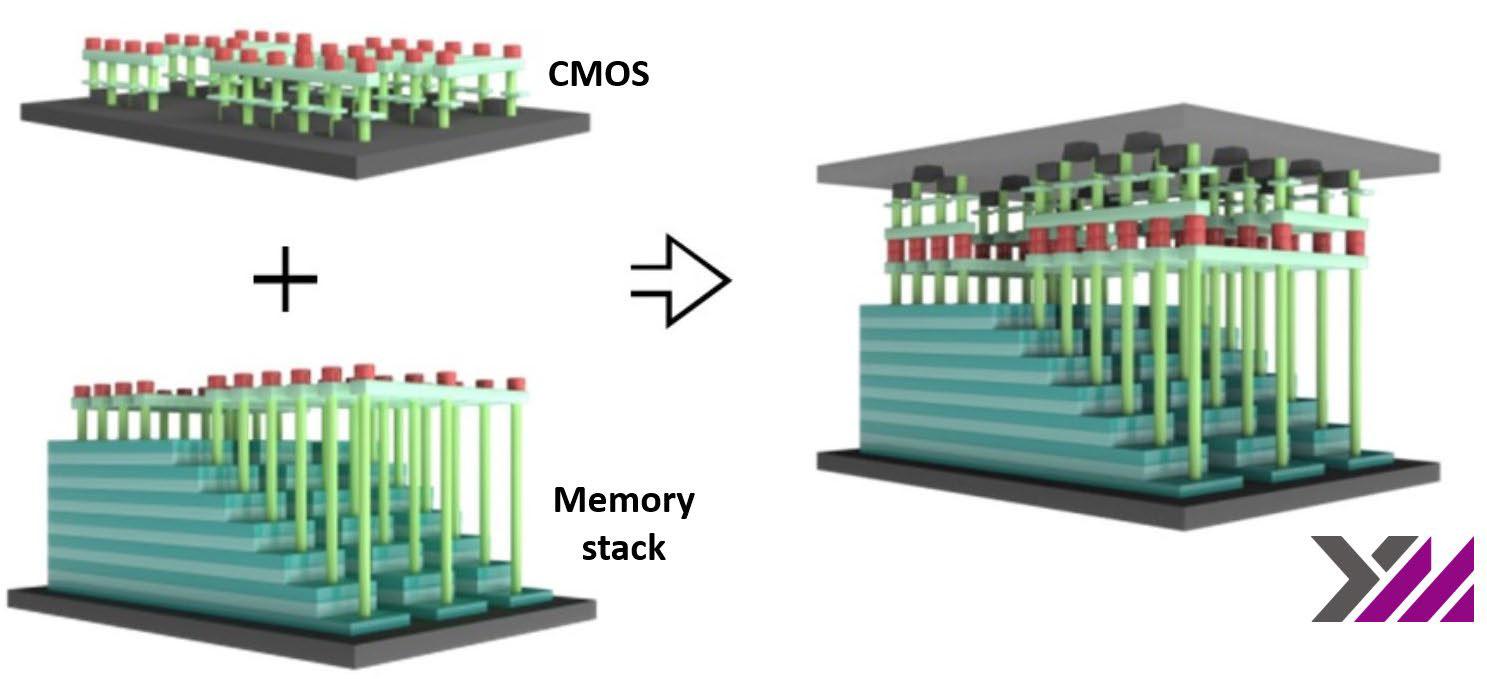

Separating the Gates from the womb is their main secret and weapon

The method of creating your NAND Flash is somewhat similar to what Intel and Micron currently use, and is nothing more than manufacturing the periphery of the chip on a wafer that is at the same time separate from the cells, which are created on another wafer.

Once they are both created they are united in a single package giving life to the chip. This method is logically more expensive to manufacture, but much faster if high performance production is sought. As expected, YMTC seeks this goal and has reached the figure of 110,000 wafers per month as of mid-2021, which is outrageous.

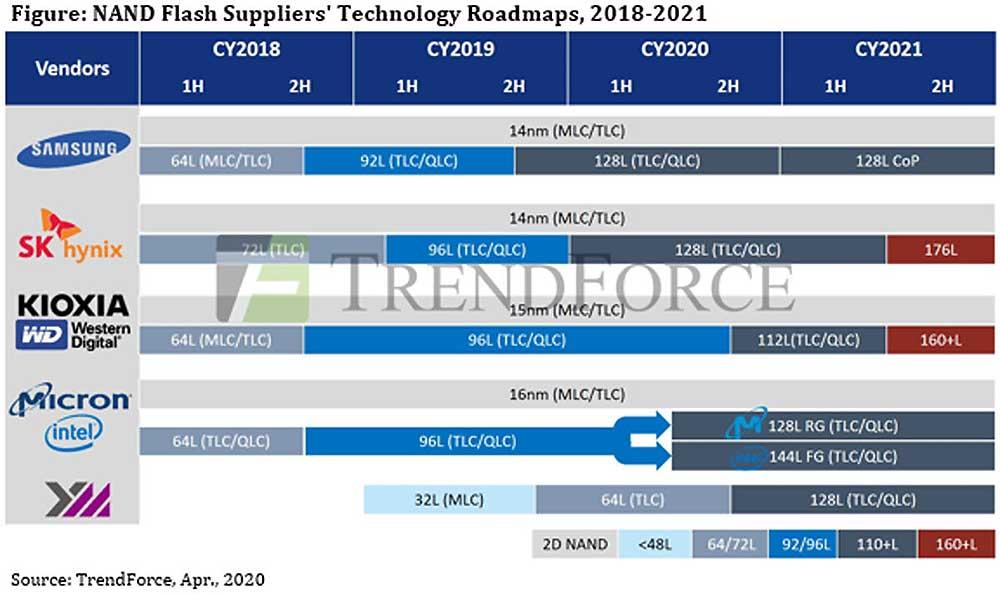

In addition, next year they will have their 128 layers ready and with it they will be up to date momentarily against their rivals, since they will offer QLC at laughable prices and in great volume. But what about the rest of the competitors? How about Intel / Micron, Kioxia / WD, SK Hynix and Samsung?

Well it’s complicated. The advancement of NAND Flash requires a lot of R&D time, NAND Flash PLCs, 180 layers and higher, are under study, but they will take time. What we do know is what will happen until the end of 2021 and it doesn’t look too good either.

Intel and Samsung lag behind, YMTC joins the fight for innovation

They say that copying is much easier than innovating, but the reality is that this will be verified as such in a sector as competitive as that of these reports at the end of 2021. The roadmap is clear: Intel and Samsung will remain at 144 layers and 128 CoP layers , while SK Hynix and Kioxia will raise the level to 176 layers and 160 layers .

YMTC will take a while to arrive, but it will be in the fight for that date with its 160 layers. So what will be the most predictable scenario? Here analysts come into play, where the figures dance depending on the agency in question. The most negative say that YMTC will reach a 4% share at the end of 2021, while the most positive say that it could monopolize an astonishing 8% from the outset.

Make no mistake, if this is true it is an apocalypse in the sector by 2022, since YMTC would have enough market share to make its way in just over a year based on a production of wafers that is between 50% and 100% greater than the rest, that is, it can produce at least twice as much as its rivals. This gives them a key advantage: They can instantly react to industry needs and accommodate prices with less volume loss.

What are the reasons for this volume and speed?

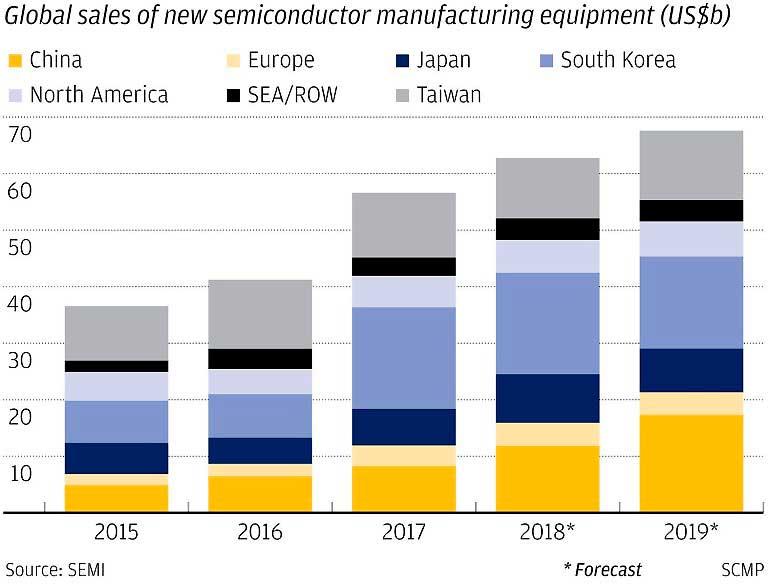

As in any company and more state-owned, being a “social-communist” system, there is a plan that they try to fulfill by all means and it is only the so-called ” Made in China 2025 “. This new regulation implies that 70% of semiconductors are produced in the country, something that is unthinkable right now and that YMTC would arrive to cover with its volume planned for that year.

What China is trying to do is be self-sufficient in a sector as key as that of semiconductors and incidentally become the largest market in the world where they stop being importers. If this were so, a large number would be lost from the small NAND Flash companies operating worldwide. They would have to disappear or sell their stakes to larger ones that would assume the capacity, technology and of course losses.

In addition, the big ones would see the world’s largest market close its doors, Kioxia would lose money quickly and would have to adjust, Micron and SK Hynix would go through quite a bit of trouble and are expected to focus on DRAM to mitigate the blow, Intel may end. definitely leaving the market and Samsung … It seems that it will be the real competitor of YMTC.

The problem is that once the Chinese dominate their market, they will expand from SSDs to DRAM in just a few years and will repeat the move with the chips for mobile phones, laptops or external cards, if nobody prevents it.

Therefore it is not an exaggeration that an apocalypse is approaching for traditional manufacturers, the first blows are already being dealt by both the US and the Chinese government with control of Hong Kong . Taiwan and Macao are resisting, but as we said a few weeks ago, we are immersed in a cold war that does not leave the dead, leaves a barren surface where that industry ends and closes.