There are many applications in the iOS App Store focused on creating budgets and although it is true that a great variety is beneficial for the user, it can often be difficult to choose one. We do not know if Moneyboard, the app that we analyze below, is or not the best because in the end it will depend on your needs and personal tastes in the interaction with the apps. However, we believe that it is one of the most prominent in terms of functions and that it is not always as well known as others.

What is MoneyBoard and where is it available

This application is presented as an expense, income and budget manager. It offers a complete interface in which to be the one who manages everything related to your finances to have a complete vision of your money. The application as such is available on both iOS, iPadOS and macOS from the App Store itself, so it not only allows us to manage it from any Apple device we have, but we are also guaranteed that it has passed through the quality filters of the company when it comes to functionality and privacy.

Is the app really free?

This application offers in-app purchases and a premium version and it is likely that after reading this you think that we have abused clickbait in the title, but in essence the application is free. You can manage the entire application without paying a single euro , although the Premium version costs 4.49 euros which we believe is not much either. This version called ‘Pro’ includes features such as being able to create several accounts, create custom categories, obtain interactive graphics and be able to dump all your data in PDF. Are they useful functions? Yes. Are they essential for everyone? Probably not.

The macOS version costs money , specifically 10.99 euros in a single payment that really is not too much money. However, unless it is essential to you, you could perfectly handle only the application for iPhone and iPad, which if it goes together and if you pay for the premium version in any of them you will also get it in the other. Here you could hit a little slap on the wrist to the developer for not having enabled universal purchases.

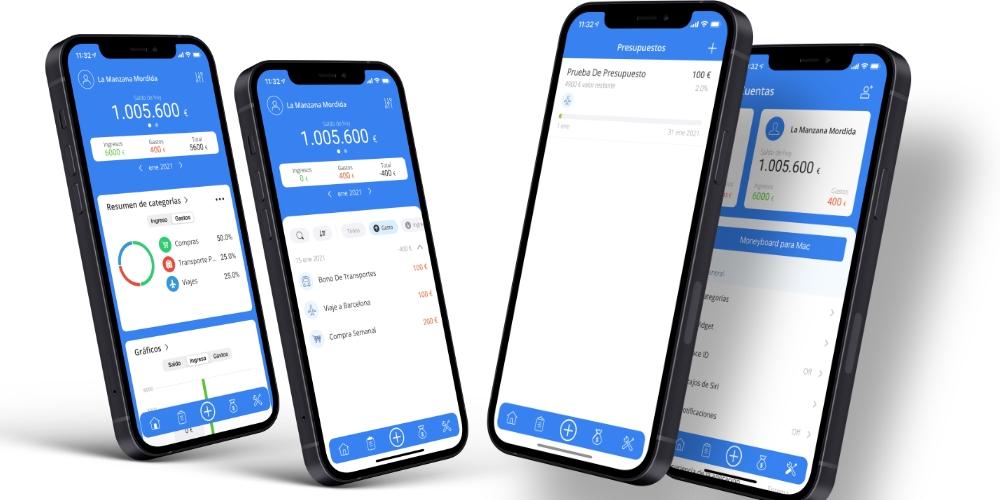

Its simple interface is appreciated

This application is minimalist in the sense that it does not bundle its appearance with endless menus in which you find yourself lost without knowing how to perform even the most basic action, something that many apps of this style unfortunately sin. The learning curve is minimal if not nonexistent. At the level of colors it is also very simple, although it allows you to change them depending on the account that is being used, going from being something only aesthetic to being functional to differentiate in which account you are finding.

The app is made up of the following 5 tabs, ordered from left to right:

- Main screen: at the top you can see the balance you have today, being able to slide to the right to see how much you will have at the end of the month. You can also vary between the different months to see the forecast. Below you can see a summary of expenses and income by categories in a graph, being able to choose between percentages or amounts. Below another graph, but this time with bars and already at the bottom a TOP of transactions. It should be noted that it is possible to choose whether you want all of this to appear on this screen or not.

- Diary: upwards you can find the same as in the previous screen with respect to the balance and already in the lower part all the expenses and income that can be sorted by categories, dates, amounts and even allows you to manually search the concepts.

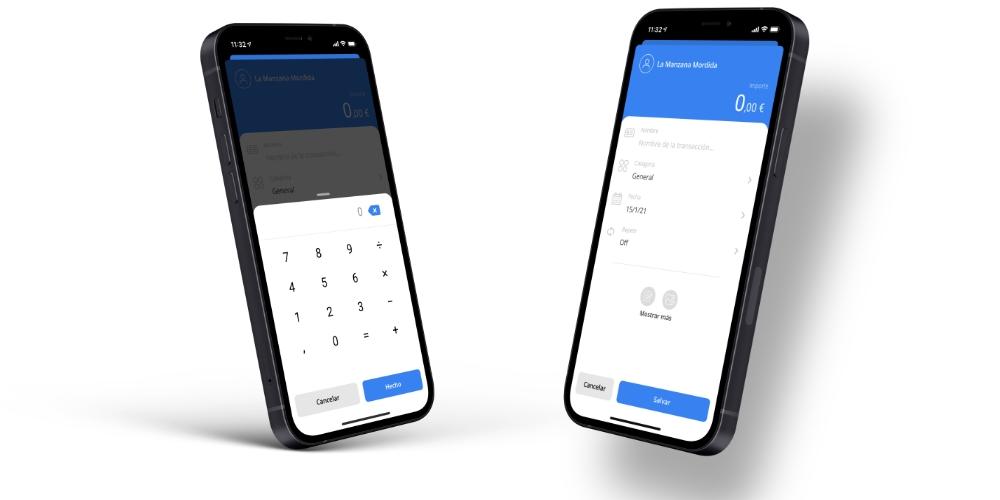

- Add:

- Spending

- Entry

- Transfer (to another Moneyboard account you have added)

- Budgets: in this section you can create as many budgets as you want, choosing the objective of these, with a start date and an end date. Once you create it, you will be able to see if you advance in your goal of saving, being able to see the expenses that you are accumulating and that in the end remain from your budget.

- Others: on the right tab you can already find the summaries of each of the accounts, the possibility of changing the settings and obtaining information about the application and its developers.

Can be protected with Face ID / Touch ID

Linked to the last point of the previous section, we find the possibility of blocking the application with the security method that we have on our iPhone or iPad. This can be very interesting in order to safeguard your account data, since in the end it can be considered sensitive data. As it is possible to protect the app of your bank account, Moneyboard also. It works like any other app with this functionality, although to put a problem we could say that it is perhaps very overwhelming that the detection appears all the time, missing an option that allows unlocking the app while the iPhone is locked and not appears until it locks again.

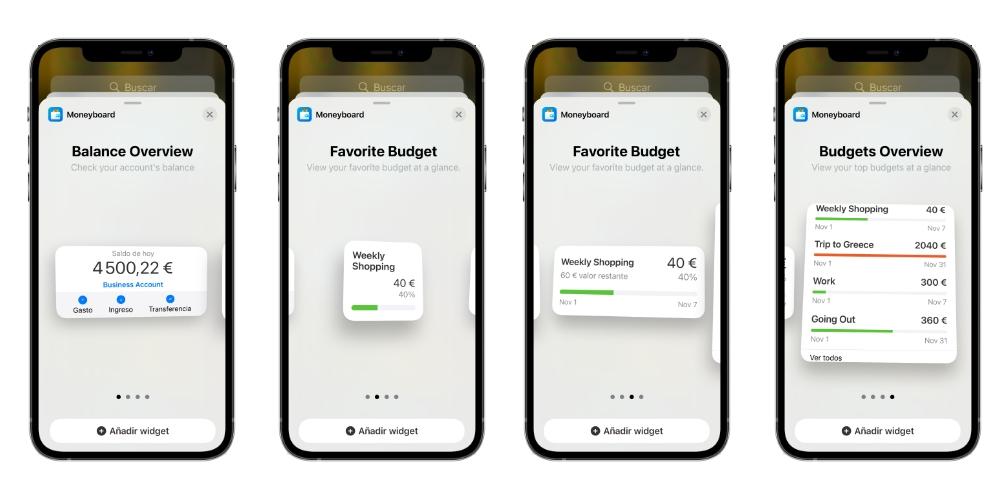

It also has widgets!

The iOS 14 version of the system allowed the iPhone to enjoy greater comfort using widgets, being able to move them around the screen and with a much more attractive design than they had. Moneyboard takes advantage of these functionalities and has widgets in 4 different sizes and in which you can obtain interesting information about your budgets or your expenses and income at a glance.

Is its main disadvantage determining?

Some applications of this style offer the possibility of linking the bank account and having the data synchronized automatically so that you do not have to manually dump the data every time you perform an operation. This, at least in our opinion, can be inconvenient. However, we must say that despite everything the application knows how to polish this lack by offering the possibility of creating certain periodic transactions that appear automatically. Either the payment of insurance, the mortgage or any other expense of a fixed amount will appear each time in the application reflected so that you only have to take care of your income and variable expenses.

Conclusion about Moneyboard

As we said at the beginning, there are many applications of this style that exist and probably none is sharply the best. However, for us, Moneyboard covers that space of demands of an average user who needs a money manager with which to see everything quickly and easily without being lazy to navigate through a sea of menus and functions. In terms of price, it is unrivaled, since the free functions are very interesting and the ‘Pro’ version has just put the icing on the cake, also being a single payment that is not high if you take advantage of the application.