In the midst of 2023, the convenience of shopping no longer necessitates rising from your sofa. Through the Internet and your mobile phone, you can comfortably conduct transactions with utmost ease and impeccable security. Nevertheless, the predicament arises when your bank unexpectedly bars online payments or restricts the use of your registered card in services such as Google Pay. Rest assured, there are valid explanations for these occurrences.

Foremost, it’s crucial to maintain a composed demeanor. The funds linked to your bank account have not vanished nor been pilfered. Numerous factors can result in the impediment of online purchases. Your bank has undertaken these measures, and your accumulated savings remain intact.

Why your bank won’t let you pay online

Whether you’re a novice or a seasoned user of online transactions, encountering difficulties in making payments within apps is a possibility. Whether you’re trying to purchase clothing, smartphones, video games, or subscriptions, your bank may impede various types of payments for a range of reasons:

Insufficient Account Balance

Your card is not authorized for online purchases

Careful attention must be given to the card chosen for online transactions. It’s possible that the card in use is not compatible with online payments or requires prior activation. In either case, it’s advisable to connect with your bank’s customer service to either acquire a new compatible card or enable the current one for online transactions.

Trading limit reached

Much like with transfers or payment apps, continuous online shopping may encounter limits. This precautionary measure safeguards against potential thefts. While some banks adjust these limits based on specific criteria, others automatically impose limits to protect customers.

You have entered the data wrong

A commonly overlooked issue leading to payment failure is incorrect data entry. Have you ensured the accuracy of the account number, expiration date, and security code? Thoroughly review these details, as a minor numerical mistake can obstruct the seamless completion of your payment. Carefully scrutinize each digit to ensure precision and avoid hasty mistakes that could jeopardize your online shopping experience.

Your account has been blocked

An additional factor that could prohibit online purchases is the blocking of your account due to various reasons. This can stem from multiple instances of incorrect access data or the detection of unauthorized access to the account. Should you inadvertently trigger an account block, the associated card will remain disabled until further clarification.

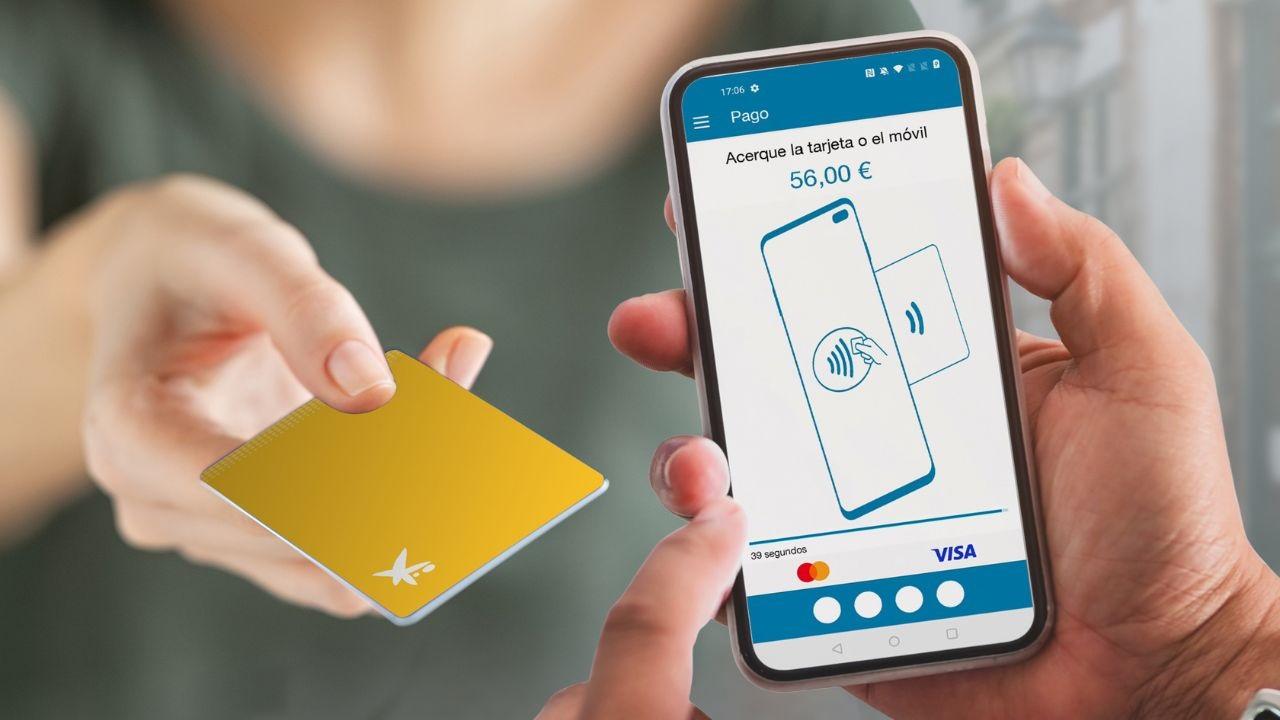

Accept the payment in the app of your bank

To preclude unauthorized transactions, banks have incorporated a function within their apps that mandates user confirmation for successful purchases. Frequently, a notification pops up in the app during the purchase process, detailing this requirement. Despite its significance, this message might sometimes escape attention.

In summary, navigating online payments and purchases has become a widespread practice. To mitigate issues related to unauthorized transactions, banks have integrated mechanisms requiring user confirmation within their apps. It’s paramount to be mindful of these factors to ensure seamless and secure online shopping experiences.