Managing your money is not the easiest thing to do. Now that many of us are facing stark inflation data and price increases that are difficult to accept, it is likely that you are thinking of helping yourself with one of those many apps that help you control every euro that you spend.

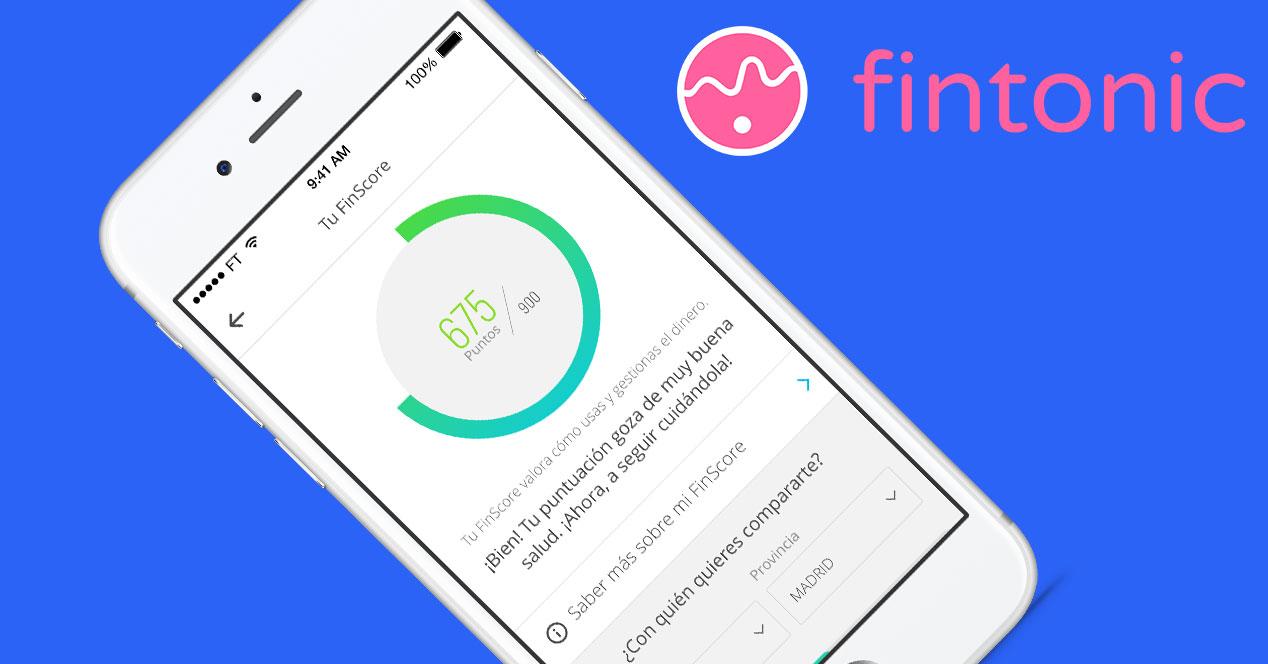

Tracking expenses and keeping up with our bank account can be a bit difficult and this is where all those personal finance apps like Fintonic or Mint come into play. But today we are not going to talk about how it works, which one is better or how to keep all our bank details up to date. Today we want to solve your doubts about its reliability.

Security measures of finance apps

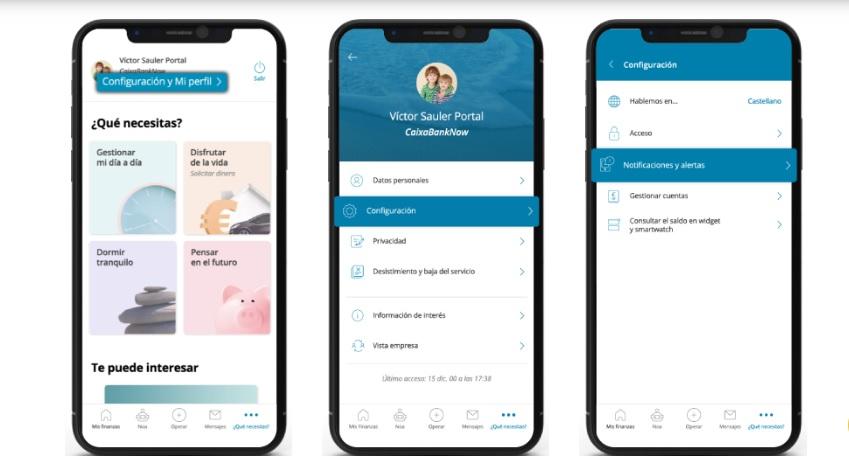

Considering that these apps can connect with your bank account to help you keep up with your spending, find out where your money is going, which products you spend the most on, and keep track of upcoming bill payments, it’s only natural that Many question whether this data can be compromised or not.

Like everything in life, despite its benefits, mobile banking and finance applications are not immune to risks . The security of mobile finance applications is something that will always be in question, due to the amount of sensitive information they handle.

It doesn’t matter if you use Mint, Fintonic or another app. Almost all of them, in their terms of use, claim that passwords and data will only be used to help you access your account and nothing more:

Your login username and passwords are securely stored in a separate database using multi-layer hardware and software encryption. We only store the necessary information to save you the hassle of manually updating, synchronizing or uploading financial information

Most apps use the type of encryption used by the main banks in their applications, with the possibility of protecting access through PIN codes for their users, and alternatives such as Touch ID and Face ID or traditional fingerprint sensors. Basically, the personal financial information that travels from our bank to these apps is encrypted and unreadable by any cybercriminal who might meddle in the transmission. In fact, Fintonic boasts that it meets all the security requirements required by the PSD2 European Directive and that, in addition, the information is protected with a 256-bit banking security level, which is the same level of protection that the most advanced banks have. .

An extra point of these applications is that, if you decide to cancel the subscription and terminate your account, because you have lost your mobile or for whatever reason, all your banking information, connections and access data are deleted from their systems automatically. permanent.

Use tips

When you use an application of this type, the security measures that you must adopt are greater to keep your bank details safe. With the options offered by the applications themselves and by following these tips, you can rest easy:

- Always download the official app : Do not download anything from outside of Google Play that may contain some type of malware that is made with the access data to your app.

- Use a strong password : Do not use the same password for everything and make sure that the one you use in these apps contains uppercase, lowercase, numbers and symbols.

- Use two-factor authentication : Whenever possible and the app allows it, in addition to traditional access with the username and password, you can identify yourself with a code that is sent to your mobile phone or email.

- Do not use public networks : Generally, a public WiFi network is not encrypted, which makes it easy for hackers to access your personal information.